Why Your Investment Banker Is Critical To Recruiting The Right Buyer

M&A Explained Series (Part 3 of 5 part series)

This is the third article in a five-part series about how putting the right team in place helps supercharge the M&A process, providing both sellers and buyers maximum value.

Imagine you are an 18-year-old football recruit. You are on a recruiting trip to a traditional blue-blood powerhouse like Michigan, Alabama or USC.

You walk onto the football stadium turf and stand breathlessly at the 50-yard line. A picture of you in full uniform pops up on the jumbotron. Over the loudspeaker, you hear the radio announcer call a play where you score the winning touchdown. The coach whispers in your ear “with our style of offense we are a perfect fit for your skills. The sky is the limit if you come here.”

And, just like that, you are hooked. Why? Because the coaching staff and athletic department created a compelling vision of things to come. In a way, that’s what Exitwise and its expert investment banking partners do when recruiting buyers for our clients who are selling. We work with investment bankers with deep industry knowledge and personal connections at the board and management level across every industry. Then, we leverage that network and knowledge to create a compelling vision for why your company is the perfect fit for that buyer.

Instead of whispering about the fit with an offensive scheme, our investment bankers are planting important seeds for the buyer:

“Their product line will complement yours perfectly and instantly boost your market share.”

“Their contract with XYZ Corporation would get you in the door and help add a major player to your client roster.”

“Their international footprint will immediately solve your supply chain issues.”

By creating this compelling vision, our team gets potential buyers see a vision for the future, generate genuine interest, and kick off the competitive bidding process. Ultimately, getting you in front of the right audience will significantly boost the likelihood of a successful outcome at an elevated price.

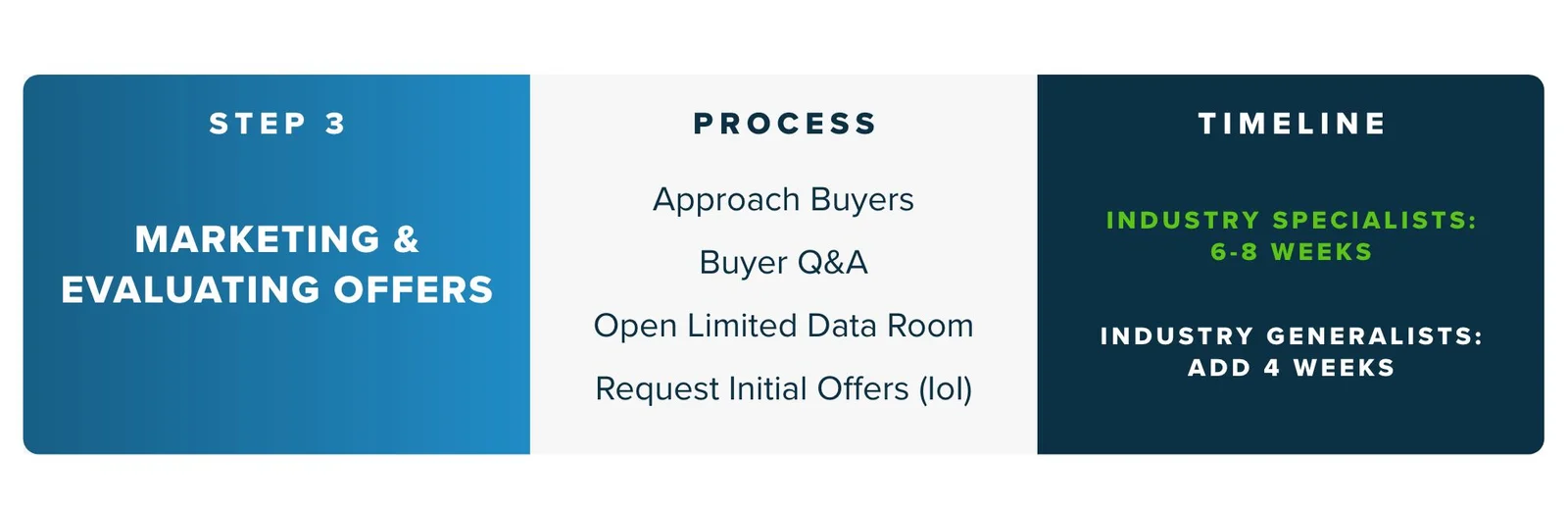

Here’s how the Marketing & Offers phase works and how Exitwise and its investment banking partners leverage their deep industry and organizational knowledge at each step in the process:

Approach Approved Buyers

In Part Two of this series, we talked about the importance of your investment banking Dream Team quickly identifying 10 to 15 likely buyers. Our investment banking partners know the companies most likely to buy – much like the coaching staffs from those powerhouse football programs know the four- and five-star recruits. This highly targeted outreach is far more effective than sending generic company marketing materials to 100 or so companies. The investment banking team, through their industry knowledge and contacts has already pre-screened highly likely buyer targets.

Does the buyer covet a particular technology that would fit its portfolio? Does the seller have particular customers that would provide immediate growth for the buyer? Would the seller’s human capital, manufacturing capabilities or IP fit a buyer’s long-term strategy?

A well-connected, industry-specific investment banker will be able to find answers to these questions to ask when selling a business and tailor pitches to buyers accordingly. The investment banker paints a vivid picture of how the seller fits the buyers short- or long-term strategy and often charts the course for the buyer’s acquisition thesis.

Buyer Discussions / Q&A

Once qualified buyers have been identified by the investment banking team, discussions between seller and buyer begin. The Buyer Discussions / Q&A step is similar to what college coaches might refer to as being “good in the living room.” In sports, it means connecting in a meaningful way with the prospect and their parents.

In the M&A process, it means facilitating a meaningful conversation between buyer and seller. The buyer will have a variety of questions ranging from financial to operational to cultural to better understand seller strengths, while at the same time, searching to uncover any M&A deal red flags. During the Buyer Discussions/Q&A phase, the investment banker and his team anticipate what questions the buyers will pose and work with the seller to make sure answers are airtight. If there are some questions that can uncover negative elements of the seller, the investment banker can work on how to best disclose this information in the best light possible.

An open, honest free flow of information is critical at this stage, for two key reasons. First, it helps to continue building interest from potential buyers. Second, it gives the seller the opportunity to manage the message with any potentially negative information the buyer will ultimately find.

At this point, the seller also opens access to the limited data room.

Opening the Limited Data Room

Here is where you give the potential buyers the first peak behind the curtain. The initial data room should include high-level detail on positive company attributes, including:

A broad overview of the company’s story;

Financials, including 3-to-5 years of historic data and a defensible outlook for the next year or two;

Any employee agreements for key people who will play an important role for the buyer post-transaction;

Ownership structure, including ownership shares and cap table;

Customer information including customer lists, customer concentration, and termination rates; and,

Intellectual property, including information on how IP impacts buyers.

The data room should focus on what’s in it for the buyer. The investment banking team can again use its deep industry knowledge to identify data room elements that will resonate.

Solicit Interest From Interested Buyers

At this point, a highly skilled investment banker will be playing one buyer off another. The highly targeted marketing materials and data room, combined with a compelling vision for the acquisition thesis, should have buyers clamoring to make the purchase. This skillfully created demand often brings multiple offers and puts the seller in the driver’s seat.

At each one of these steps the investment banking team’s intimate knowledge of potential buyer needs builds a crescendo of demand. Much like college coaches building excitement among their recruits, the ultimate goal is to build interest in the seller, then get the buyer to sign on the dotted line. The key, of course, is finding the right investment banking team up front. At Exitwise, our ability to connect sellers to our network of well-connected, industry specific investment bankers, lawyers and tax accountants provides the foundation to build demand in the Marketing & Offers phase.

M&A Explained | Five Part Founder Series

Read the full, five-part series detailing business owner M&A ("Mergers and Acquisitions") best practices when looking to sell a company:

Part 1: Supercharging Your M&A Process and Maximizing Your Exit

Part 2: Laying The Groundwork for M&A Success

Part 4: The Importance of Negotiation and Buyer Selection in M&A

Part 5: Avoid the Fourth Quarter Fumble: M&A Diligence and Documentation