Beyond Venture Capital: Exploring Funding Options for Entrepreneurs in 2023

Venture Capital and Entrepreneurship

Venture Capital and Entrepreneurship

The process of securing capital can be a daunting and extremely stressful aspect of any entrepreneur's startup journey. And in the ever-evolving economic landscape, some founders find themselves desperately seeking viable solutions to fuel their ventures' growth. Venture Capital (also known as "VC" or "VC funding") has emerged as a vital source of financing for startups, early-stage ventures, and emerging companies with significant growth potential. VC firms have historically provided much-needed capital in exchange for an ownership stake, shouldering the risk associated with investing in promising but risky ventures. Venture capitalists bring not only financial resources but also managerial expertise and industry connections to help these companies thrive.

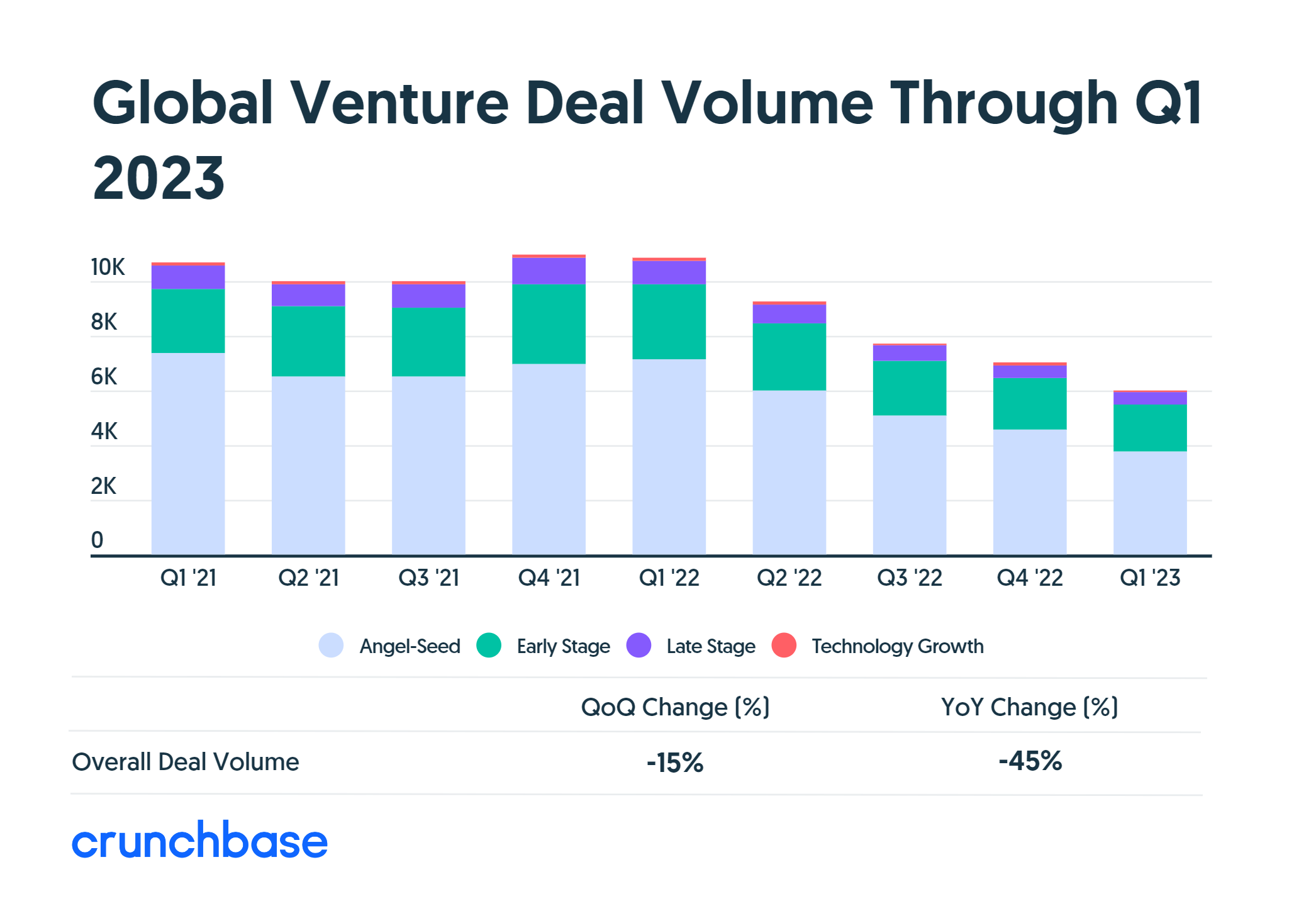

However, despite economic tailwinds seemingly on the horizon, venture capital funds don't seem to be raising or deploying capital as aggressively as we've seen in years prior. In an April 5, 2023 article in Crunchbase News, global venture capital funding fell 53% year over year to $76 billion in the first quarter of 2023. This was the largest quarterly decline in venture capital funding since the financial crisis of 2008. The decline was driven by a number of factors, including rising interest rates, economic uncertainty, and the war in Ukraine. This could mean a funding shortfall for both new startups trying to find product market fit, or established companies seeking their next round of funding.

In this article we will explore the various of funding options that a business owner can look to should venture capital not be an option:

Private Equity ("P/E")

Private equity refers to an investment made into privately held companies. Private equity firms pool together capital from institutional investors, high-net-worth individuals, and other sources to invest in promising businesses with significant growth potential. Private equity can offer access to substantial capital, strategic expertise, and industry connections that can fuel a business's expansion and success. In contrast to the higher-risk, early stage companies that venture capital firms typically invest in, private equity funds traditionally focus on established, revenue or profit generating businesses with a sustainable and growing customer list and business model.

Angel Investors

Angel investing plays a vital role in the startup ecosystem, offering a unique blend of financial support, mentorship, and industry expertise to early-stage ventures. Angel investors are typically successful individuals who provide capital from their personal funds to startups in exchange for equity ownership. Beyond the financial investment, angel investors often take a hands-on approach, actively engaging with the entrepreneurs they back. They bring not only their financial resources but also their valuable networks, industry knowledge, and entrepreneurial experience to the table. Angel investors can serve as trusted advisors, offering strategic guidance and helping startups navigate challenges, refine their business models, and accelerate growth. Their involvement can provide startups with a significant advantage, as they tap into the insights and connections of seasoned professionals who have successfully navigated the entrepreneurial journey themselves.

Crowdfunding

Crowdfunding is a way to raise money from a large group of people, typically through an online platform (e.g., StartEngine). In a crowdfunding campaign, startups create compelling marketing materials that outline their business ideas, products, or projects. Once signed up on the platform, individual investors can contribute funds in exchange for rewards, equity, or simply the satisfaction of supporting a promising venture. Crowdfunding offers startups an opportunity to access capital from a wide network of potential backers who believe in their mission, even if traditional avenues like venture capital or angel investment may be less accessible. By leveraging the power of the crowd, startups can not only secure much-needed capital but also gain exposure, validation, and valuable market feedback from early adopters and potential customers.

Bootstrapping

Bootstrapping a business means growing it without relying on external funding. Instead, founders utilize their own personal savings, revenue generated by the business, or loans from friends and family to fund operations and expansion. Bootstrapping allows founders to retain full ownership and control over their ventures, which can be highly attractive especially to entrepreneurs considering a future sale. By retaining a significant portion of equity, founders position themselves to benefit directly from the value they create over time, and can result in higher potential financial gains when an exit occurs. Bootstrapping also instills discipline and resourcefulness in founders, forcing them to be creative, efficient, and focused on generating revenue and profitability from early stages. While bootstrapping may involve slower growth compared to ventures with external funding, it offers founders the opportunity to shape their businesses according to their vision and priorities, maximizing their potential rewards when it's time for the startup to exit.

SBA (Small Business Administration) Loans

SBA loans, offered by the U.S. Small Business Administration, provide a viable option for entrepreneurs seeking capital to fund their startups. These loans are specifically designed to support small businesses and startups that may face challenges accessing capital through other means. SBA loans can offer favorable terms, such as lower interest rates and longer repayment periods, making them an attractive choice for entrepreneurs in need of capital. The SBA guarantees a portion of the loan, reducing the risk for lenders and increasing the chances of approval for startups. With that said, SBA loans often require personal guarantees from the business owner or owners, which means that they become personally liable for the repayment of the loan. This places their personal assets at risk in the event of loan default.

Line of Credit

A line of credit is a flexible financing option that can provide entrepreneurs with access to cash when they need it most. This can be used to cover unexpected expenses, invest in growth opportunities, or secure other forms of financing. When considering a line of credit, it is important to shop around and compare rates, choose a term that fits your needs, and understand the repayment terms.

Grants

Unlike loans or equity financing, grants provide non-repayable funds and often come with fewer restrictions, offering flexibility in utilizing the capital. Grants can enhance cash flow, attract additional investors, and provide validation to startups focused on social or environmental goals. However, securing grants can be competitive and requires thorough research and alignment with specific criteria. Founders should consider grants as part of a diversified funding strategy, combining them with other financing options to maximize their chances of success and fuel their startup's journey to success.

Conclusion

In conclusion, entrepreneurship is a challenging journey, and securing capital is a crucial aspect of growing a successful business. As a founder, it is essential to understand the shifting landscape of growth capital availability, and to explore a variety of options for funding a business. Seeking the guidance of experienced growth capital advisors and connecting with fellow founders who have navigated successful funding rounds can provide invaluable insights and advice. By aligning with knowledgeable advisors and tapping into the wisdom of experienced entrepreneurs, you can better understand the funding landscape and make informed decisions about the best strategies to fuel your business's growth. Remember, while venture capital may not be readily accessible for every business or startup, there are diverse funding options available that can provide the necessary capital to unlock your business's full potential. Stay resilient, stay open to new possibilities, and leverage the power of a supportive network to achieve your entrepreneurial goals.